The cryptocurrency world is constantly evolving, and exchanges are at the heart of that transformation. One platform that has gained significant traction in the crypto trading scene is Bybit. Whether you’re a beginner just entering the world of crypto or an advanced trader looking for robust tools, Bybit is often touted as a top-tier exchange. But what makes it stand out? In this detailed review, we’ll compare Bybit across key categories to see how it stacks up against the competition and whether it’s the right platform for your trading needs.

Introduction to Bybit

Overview of Bybit

Launched in 2018, Bybit is a crypto derivatives and spot trading exchange known for offering advanced features like leverage, perpetual contracts, and a highly responsive user interface. The platform has rapidly climbed the ranks, attracting millions of traders due to its intuitive design and a strong focus on security. What really sets Bybit apart, though, is its focus on derivatives trading, which has become a huge draw for advanced traders seeking leveraged products.

Read More

Why Bybit Stands Out in the Crypto Exchange Market

In a crowded space filled with numerous exchanges, Bybit distinguishes itself through fast transaction speeds, deep liquidity, and cutting-edge features that cater to both retail and institutional traders. Moreover, with a zero-downtime policy during periods of high volatility, Bybit has earned a strong reputation for reliability during crucial market movements.

The Importance of Understanding Crypto Exchanges

Before diving into Bybit’s offerings, it’s important to recognize that not all exchanges are created equal. While some are perfect for beginners, others like Bybit offer a more sophisticated trading environment that requires knowledge of terms like futures, perpetual contracts, and leverage. Understanding these core concepts will help you make an informed decision about whether Bybit fits your needs.

1. User Interface and Platform Experience

Intuitive User Design for Beginners and Experts

When it comes to usability, Bybit shines by offering a clean and straightforward interface. Advanced traders can appreciate its customizable dashboards and access to technical charts, while beginners can take advantage of the user-friendly spot trading interface. Both mobile and desktop users benefit from minimal latency, which ensures smooth operation even during times of high traffic.

Mobile and Web Platforms

The Bybit app is available on both Android and iOS, offering a seamless experience akin to its desktop counterpart. Whether you’re trading on-the-go or at your desk, the mobile app delivers real-time data, advanced charting, and push notifications for critical market movements.

Customizability and User Preferences

One of Bybit’s unique features is the ability to customize the trading interface. Users can select between different views, change chart types, and add specific indicators to suit their individual trading styles. This level of personalization is particularly useful for experienced traders who want full control over their trading environment.

2. Trading Pairs and Market Availability

Variety of Cryptocurrencies Offered

Bybit supports a growing list of cryptocurrencies in both its spot and derivatives markets. Popular assets like Bitcoin (BTC), Ethereum (ETH), XRP, and Solana (SOL) are among the key coins available, alongside several altcoins that are consistently being added to the exchange.

Availability of Perpetual Contracts and Futures

Perpetual contracts are a core feature of Bybit, allowing traders to open positions without an expiry date. The absence of settlement times gives traders more flexibility, while Bybit also offers inverse perpetual contracts, allowing you to trade using base currencies like Bitcoin instead of USDT.

Spot Trading vs. Derivatives on Bybit

While derivatives trading is Bybit’s forte, the platform has expanded its offerings to include spot trading, which caters to users who prefer to buy and hold assets without leverage. This diversification makes Bybit a more versatile option for a broader range of traders.

3. Fees and Transaction Costs

Trading Fees: Maker vs. Taker

Bybit uses a maker-taker fee model, with makers (those who provide liquidity by placing limit orders) being charged a lower fee than takers (those who take liquidity by executing market orders). For spot trading, taker fees are typically around 0.1%, while maker fees can be as low as 0% during promotional periods. On the derivatives side, fees range between 0.025% (makers) and 0.075% (takers).

Deposit and Withdrawal Fees

Deposits on Bybit are free, but withdrawal fees are standard across the industry, depending on the specific cryptocurrency being withdrawn. Bitcoin withdrawals, for instance, incur a 0.0005 BTC fee.

Competitive Pricing in the Industry

Compared to other major exchanges, Bybit’s fees are highly competitive, especially for traders who engage in high-volume transactions. Additionally, there are often fee rebate programs for users who provide liquidity to the platform.

4. Security and Safety Measures

Bybit’s Security Features: Two-Factor Authentication, Cold Storage, etc.

Security is one of Bybit’s strong suits. The platform employs industry-leading security protocols, including cold storage for the vast majority of funds, two-factor authentication (2FA), and SSL encryption to protect users’ accounts.

History of Hacks or Breaches (or Lack Thereof)

To date, Bybit has a clean record with no major security breaches or hacks, a testament to its robust infrastructure. However, the exchange is continually auditing its security protocols to stay ahead of potential threats.

Insurance Fund and Asset Protection

Bybit has also set up an insurance fund to mitigate losses in the event of unexpected market volatility or liquidation issues. This further strengthens its position as a safe and reliable platform for both retail and institutional traders.

5. Leverage and Margin Trading Options

Overview of Bybit’s Leverage Offerings (up to 100x)

Bybit allows users to trade with leverage as high as 100x on certain trading pairs. While high leverage can amplify profits, it’s essential to understand the risks involved, as it can also magnify losses.

Risks and Rewards of Using Leverage

Leverage can be a double-edged sword. Bybit provides risk management tools, such as stop-loss orders and take-profit levels, to help traders minimize their exposure, but it’s important for traders to use leverage wisely.

Comparisons to Other Platforms

In comparison to other major exchanges, Bybit’s leverage options are more flexible, with lower margin requirements. However, users must be cautious, as high leverage significantly increases the risk of liquidation.

Click here to learn about Tonkeeper

6. Liquidity and Market Depth

Daily Trading Volume and Market Activity

Bybit is among the top exchanges in terms of liquidity. With millions of dollars traded daily, the platform ensures that users can execute large trades with minimal slippage. Bybit’s deep liquidity is particularly important for professional traders executing high-frequency strategies.

How Liquidity Impacts Trades and Slippage

Slippage refers to the difference between the expected price of a trade and the price at which it’s actually executed. Bybit’s high liquidity helps minimize slippage, especially in fast-moving markets.

Bybit’s Role in Global Crypto Liquidity

As one of the top five derivatives exchanges by volume, Bybit plays a pivotal role in providing liquidity for Bitcoin and other major cryptocurrencies.

7. Deposit and Withdrawal Options

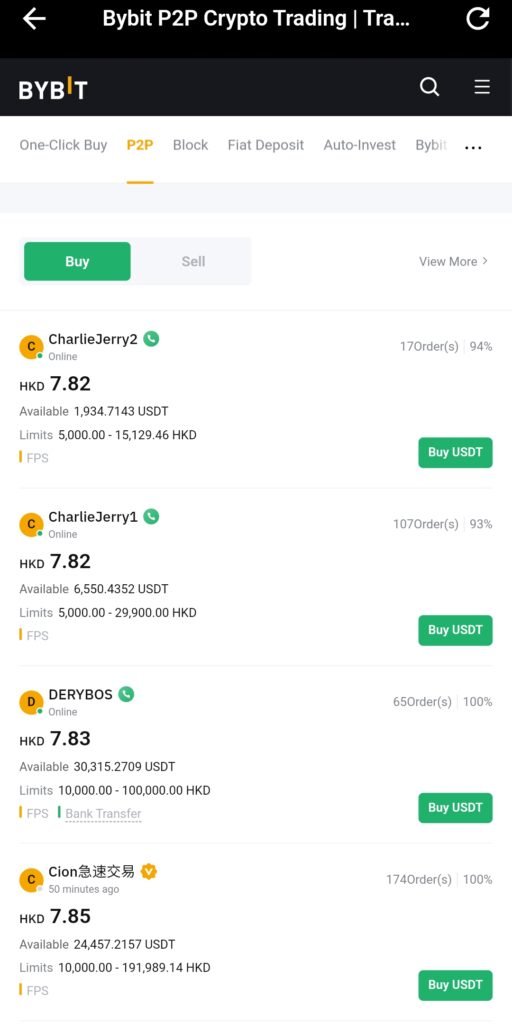

Supported Payment Methods (Bank Transfers, Crypto Deposits, etc.)

Bybit supports multiple payment options, including crypto deposits, fiat on-ramps through third-party providers, and bank transfers via partnerships with payment processors like Simplex and Banxa.

Processing Times for Withdrawals

Withdrawals on Bybit are processed three times a day, with a typical processing time of 30 minutes to an hour. However, this may vary based on network congestion.

Fiat On-Ramps/Off-Ramps

Bybit has significantly expanded its fiat support, allowing users to buy cryptocurrencies directly with fiat through credit cards and bank transfers. This bridges the gap between traditional finance and crypto markets.

8. Customer Support and Service

24/7 Support Channels (Live Chat, Email, Phone)

Bybit offers 24/7 customer support via live chat, email, and an extensive Help Center filled with FAQs. The support team is known for being responsive and helpful, often resolving issues within a few hours.

Responsiveness and Problem Resolution

In addition to standard support channels, Bybit has a vibrant community forum and presence on social media platforms like Twitter and Telegram, where users can interact with both the team and other traders.

Community Resources and Tutorials

To educate traders, Bybit offers a range of tutorials and educational resources, including video guides and blog posts on advanced trading strategies.

9. Regulatory Compliance and Reputation

Bybit’s Legal Standing and Compliance with Regulations

Bybit is registered in the British Virgin Islands and complies with Know Your Customer (KYC) procedures for large withdrawals. While the platform is accessible in most regions, there are a few geographic restrictions based on local regulations, including the U.S.

Global Availability and Restrictions

Though Bybit is available to traders in most countries, restrictions exist for users in jurisdictions like the United States and China due to regulatory concerns.

Transparency and Trustworthiness in the Crypto Space

Bybit has made strides in being transparent about its operations, fees, and risks, earning it a reputation as one of the more trustworthy exchanges in the crypto world.

10. Staking and Yield Farming Opportunities

Bybit’s Staking Programs and APYs

While staking is relatively new to Bybit, they have rolled out competitive staking programs with attractive APYs. For example, users can stake ETH, USDT, and other assets for flexible returns.

Passive Income Opportunities for Users

Beyond staking, Bybit offers yield farming opportunities that allow users to participate in liquidity pools and earn rewards. These passive income streams are ideal for long-term holders looking to grow their portfolios without active trading.

How It Compares to Other Platforms

Compared to competitors, Bybit’s staking and yield farming offerings are relatively new but competitive, providing decent returns with minimal risk.

11. Promotions and Referral Programs

Bonus Offers and Sign-Up Incentives

Bybit frequently offers bonus incentives for new users, including deposit bonuses, fee rebates, and trading competitions with large prize pools.

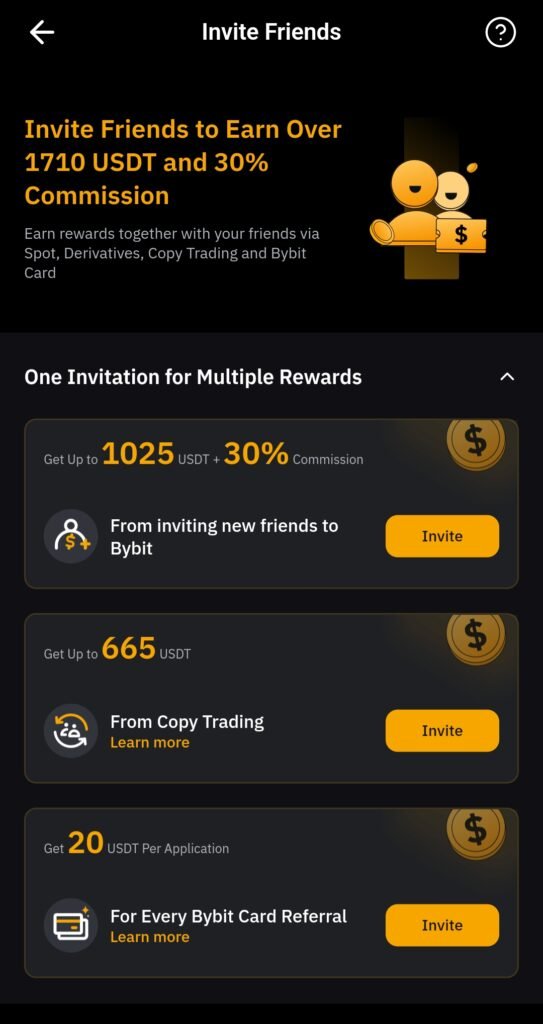

Bybit’s Referral System

Bybit’s referral program is a win-win for both the referrer and the new user, offering both parties fee discounts and bonus funds for trades. Referrers can earn up to 30% of their referrals’ trading fees.

Loyalty Programs and VIP Benefits

High-volume traders can gain access to VIP benefits, including reduced fees, personalized support, and early access to new features.

12. Educational Resources and Learning Tools

Bybit’s Blog, Webinars, and Tutorials for New Traders

Bybit goes beyond just being an exchange by offering a wealth of educational content for both new and advanced traders. Their blog regularly updates users on market trends, while webinars cover a range of trading strategies and platform features.

Advanced Trading Tools and Analysis

For seasoned traders, Bybit provides access to a suite of advanced tools, including TradingView charts, order types, and API access for algorithmic trading.

How Bybit Educates Users on Risk Management

Risk management is key in leveraged trading, and Bybit ensures its users are well-equipped with resources that teach proper risk mitigation strategies, such as position sizing and the use of stop-loss orders.

13. Mobile App Performance

Bybit’s Mobile App Functionality and Usability

The Bybit app is a powerhouse, providing all the functionality of the desktop platform. Users can access real-time charts, place orders with a single tap, and even customize alerts to stay on top of market changes.

Feature Parity with Desktop Experience

Bybit has worked hard to ensure that the mobile app mirrors the desktop platform in terms of features. From advanced charting tools to one-click liquidation, mobile users won’t feel left out.

Speed, Reliability, and User Feedback

User feedback consistently praises the app for its speed and reliability, even during periods of extreme market volatility. Updates are frequent, improving both performance and security.

14. Innovation and Future Developments

New Features and Products in Bybit’s Pipeline

Bybit is always innovating, with recent introductions like NFT marketplaces, options trading, and DeFi integration being just a few examples of how the platform stays ahead of trends.

Bybit’s Vision for the Future of Crypto Trading

With its focus on security, usability, and expansion, Bybit aims to be a major player in the future of decentralized finance (DeFi) while maintaining its position as a leading derivatives exchange.

Expansion Plans and Upcoming Market Trends

Bybit’s expansion into global markets, along with its plans to further integrate DeFi and Web3 technologies, ensures it will remain competitive as the crypto landscape evolves.

15. Pros and Cons of Bybit

Strengths and Weaknesses of the Platform

Pros:

- Fast and reliable platform, even during high-volume periods.

- Advanced features for derivatives and spot trading.

- Competitive fees and deep liquidity.

- Strong security measures with cold storage and insurance funds.

- Highly responsive customer support.

Cons:

- Restricted in certain jurisdictions, including the U.S.

- Not as beginner-friendly for users unfamiliar with leveraged products.

- Relatively new to staking and yield farming compared to other platforms.

What Bybit Does Better Than Competitors

Bybit excels in derivatives trading and providing a seamless mobile experience. Its ability to handle high-volume trades without downtime makes it a go-to choice for professional traders.

Areas Where Bybit Could Improve

Although Bybit is continually expanding, it could improve its presence in fiat-to-crypto services and refine its offerings for retail investors who prefer simple, non-leveraged trading options.

Conclusion: Should You Use Bybit for Crypto Trading?

In conclusion, Bybit is an excellent platform for those who understand the intricacies of crypto trading, particularly in the derivatives market. With its deep liquidity, robust security measures, and a platform built to handle high-frequency trading, Bybit has proven itself to be a top contender in the world of cryptocurrency exchanges. While it may not be as beginner-friendly as some competitors, its advanced tools, innovative features, and responsive customer support make it a great choice for both intermediate and advanced traders.

So, should you use Bybit? If you’re looking for a reliable, feature-packed exchange with competitive fees and excellent trading infrastructure, Bybit is definitely worth considering.

FAQs

1. What is Bybit, and how does it work? Bybit is a cryptocurrency exchange that offers both spot and derivatives trading, including perpetual contracts and futures. It is known for its high liquidity, competitive fees, and advanced trading features like leverage and margin trading.

2. Is Bybit safe for trading cryptocurrencies? Yes, Bybit employs top-tier security measures like two-factor authentication, cold storage for most funds, and an insurance fund to protect users from unexpected losses.

3. What are Bybit’s fees, and how do they compare to competitors? Bybit offers competitive fees, with taker fees around 0.1% for spot trading and 0.075% for derivatives. It also offers rebates for market makers, which is relatively rare among crypto exchanges.

4. Can beginners use Bybit, or is it suited for advanced traders only? While Bybit offers a range of educational resources, its platform is best suited for traders with some experience, especially those looking to trade with leverage. Beginners may find other exchanges more user-friendly for non-leveraged trades.

5. Does Bybit offer any bonuses or referral programs for new users? Yes, Bybit frequently runs promotions, including deposit bonuses and trading competitions. Its referral program allows users to earn a percentage of their referrals’ trading fees.

Nice review